2022 annual gift tax exclusion amount

The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022. If you own company-granted stock options determine whether now is the time to exercise or disqualify.

Bland Garvey Cpa Gift Estate Tax Exemption 2 Richardson Tx

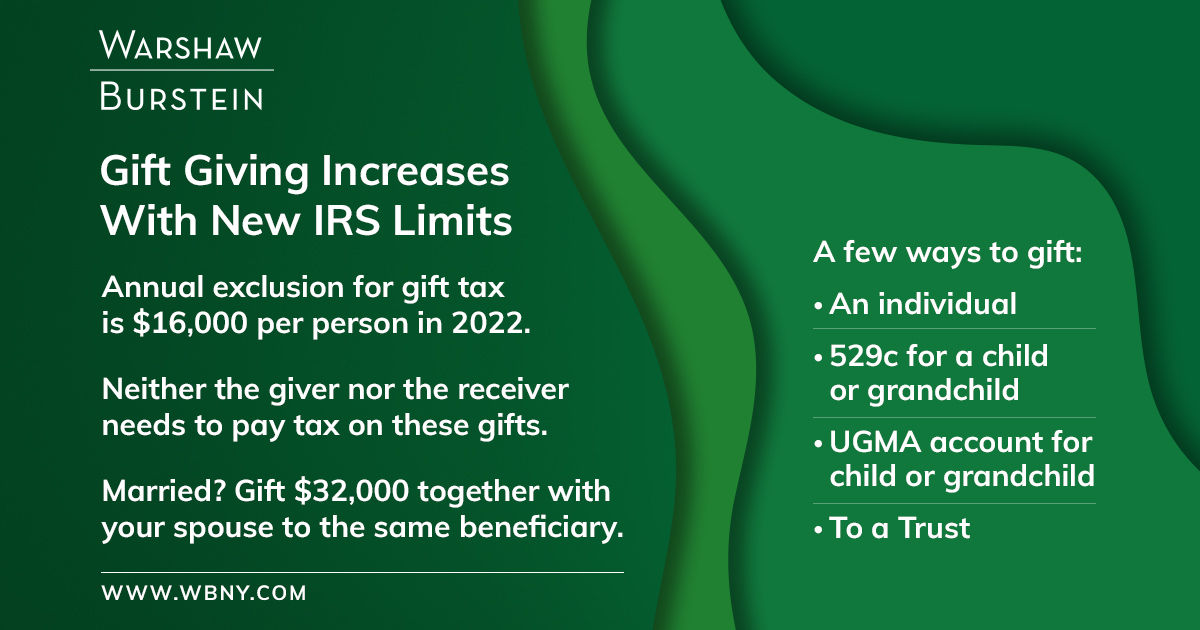

Moreover the annual gift tax exclusion is set to rise from 16000 per donee in 2022 to 17000 per donee in 2023.

. Starting in 2022 currently proposed legislation would reduce the annual gift tax exclusion to 10000 per year per donee recipient. 306 views Premiered Feb 2 2022 Attorney Burton discusses the new annual exclusion gift amount for 2022 in this video entitled - How Much Can I Give Away Tax Free in 2022. The annual gift tax exclusion amount for 2022 gifts to individuals is 16000.

This means that any individual can give up to 17000 to any. The annual exclusion applies to gifts to each donee. 1 That means if you had the money you could whip out your checkbook and write 16000 checks to your mom your.

Annual Gift Tax and Estate Tax Exclusions Are Increasing in 2022 The amount you can gift to any one person on an annual basis without filing a gift tax return is increasing to 16000 in 2022. 13 rows For the tax year 2022 the lifetime gift tax exemption is 1206 million per person. Itll also limit the donor to 20000 annual exclusion.

However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each. This means that you can give up to 16000 to anyone without having to worry about. You can give up to 15000 worth of.

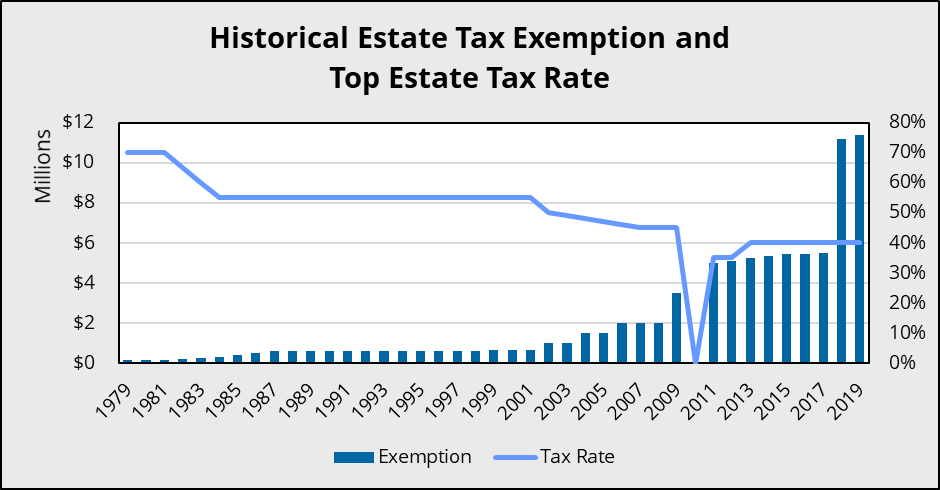

The annual exclusion for gifts is 11000 2004-2005 12000 2006-2008 13000 2009-2012 and 14000 2013-2017. These amounts are adjusted for inflation on an annual basis. The annual gift exclusion is applied to each donee.

The federal government imposes a tax on gifts. Annual Gift Tax Limit for 2022 The annual gift tax limit is 16000 per person in 2022. For example assume that in 2022 you give gifts totaling.

Unified Estate and Gift Tax Exclusion also known as the lifetime exemptionFor 2022 the total lifetime gifts. The maximum credit allowed for adoptions for tax year 2022 is. The IRS released Revenue Procedure 2021-45 which announces the increase in 2022 of the estate gift and generation-skipping transfer tax applicable exclusion amounts from.

In 2021 the exclusion limit is 15000 per recipient and it rises to 16000 in 2022. This 12060000 million lifetime gift tax exclusion means that even if you are required to file Form 709 because you gave away more than 16000 to any one person during. 13 rows The IRS allows individuals to give away a specific amount of assets or property each year.

In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. Jan 04 2022 This is a 1000 increase from the 2021 exclusion of 15000.

The Internal Revenue Service the IRS has announced the 2022 estate and gift tax exclusion amount. The first tax-free giving method is the annual gift tax exclusion. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax -free without using up any of his or her lifetime gift.

The gift tax exclusion for 2022 is 16000 per recipient. In 2018 2019 2020 and 2021 the annual exclusion is 15000. For 2022 the annual gift exclusion is being increased to 16000.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Estate Gift Tax Changes In 2022 Dmh Legal Pllc

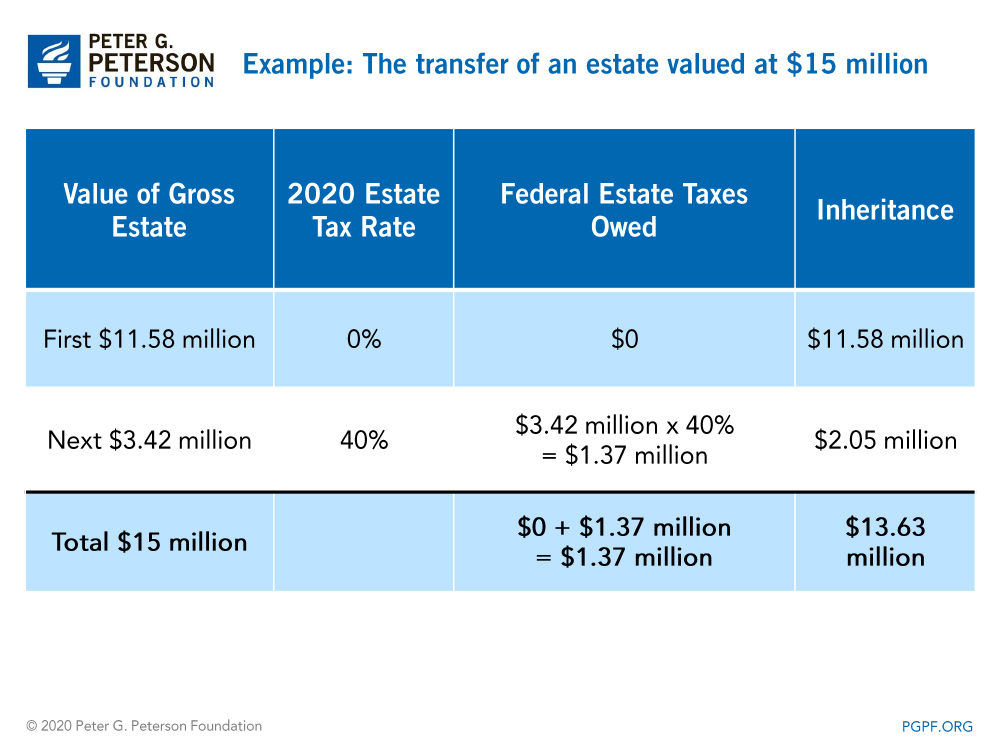

What Are Estate And Gift Taxes And How Do They Work

2022 Income Tax Brackets And The New Ideal Income

Sharing The Wealth How Lifetime Gift Tax Exemption Works Charles Schwab

Annual Gift Tax Exclusion Vs Medicaid Look Back Period Cornetet Meyer Rush Stapleton

Warshaw Burstein On Twitter Gift Giving Increases With New Irs Limits The Annual Exclusion For Gift Tax Is 16 000 Per Person In 2022 There Are A Few Ways To Gift Where Neither

Projected Increases In 2022 For The Gift Tax Annual Exclusion Amount And Lifetime Exemption Preservation Family Wealth Protection Planning

Gift Tax 101 Should The Annual Exclusion Amount Limit Your Generosity Professional Financial Solutions

Annual Gift Tax Exclusion Increases In 2022

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Gift Tax Limit 2022 How Much Can You Gift Smartasset

2022 Estate Gift And Gst Tax Exemptions Announced By Irs Nixon Peabody Blog Nixon Peabody Llp

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Estate Gift Tax Estate And Gift Dynamics In The Era Of The Big Exemption

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset